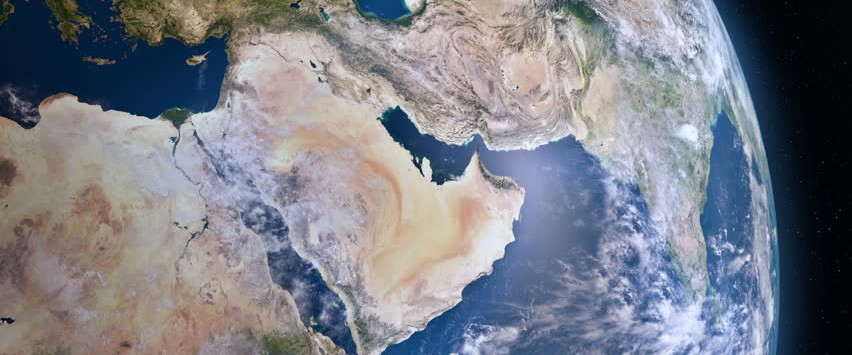

Previously, we reported that global upstream operators will cut investment for a second consecutive year in 2026, with capital expenditure expected to fall by at least 2-3% year-on-year, and more than 5% compared to 2024 levels, as the industry navigates sub-$60/bbl oil prices while maintaining focus on long-term resilience. Still, Wood Mackenzie has predicted that operators will continue to add strategic, new growth opportunities in several regions across the globe. To wit, the Middle East and North Africa are slated to add at least 20 billion barrels of oil equivalent through the 2030s through licensing rounds and contract negotiations.

Libya’s National Oil Corporation (NOC)launched its first oil exploration bid round in over 17 years in March 2025, with companies expected to submit offers and open bids in February 2026, covering 22 onshore and offshore blocks to boost production and attract foreign investment after years of instability. The move aligns with Libya’s goal to reach 2 million barrels per day (bpd) production, a level near pre-2011 crisis output. This initiative is seen as a landmark moment, opening a significant, resource-rich market to international energy companies.

Meanwhile, Iraq, Kuwait, Oman, and Syria are indeed poised to offer significant new oil drilling opportunities, driven by Iraq and Oman building export pipelines, Kuwait expanding offshore, and Syria opening up after years of conflict for new investment, signaling major developments in the Middle East’s upstream sector. These countries are focusing on diversification and revitalizing fields, with Iraq and Oman planning a major Basra-to-Duqm pipeline and Syria attracting new partners for redevelopment. Iraq and Oman have a preliminary agreement to build a crude oil pipeline from Basra to Duqm, diversifying Iraq’s export routes beyond the Ceyhan pipeline. Oman’s Duqm port will host storage facilities, making it a key export hub, bypassing the Strait of Hormuz chokepoints.

Kuwait is expanding offshore production and drilling, with major finds like the Nokhetha discovery. This is a major offshore oil and gas find by Kuwait Oil Company (KOC) east of Failaka Island, containing estimated reserves of 2.1 billion barrels of light oil and 5.1 trillion cubic feet of gas (about 3.2 billion barrels of oil equivalent). This discovery marked a significant milestone in Kuwait’s offshore exploration program, part of a broader strategy to boost national energy security, with subsequent finds like Jaza reinforcing these efforts, noted for high-quality, low-emission resources. ADNOC Drilling is expanding into Kuwait and Oman by acquiring a 70% stake in SLB’s (NYSE:SLB) land drilling rig business, securing six rigs in Oman and two in Kuwait, with plans to double that fleet and further grow in the region through new tenders and acquisitions, marking a significant regional expansion.

Source: Oilprice